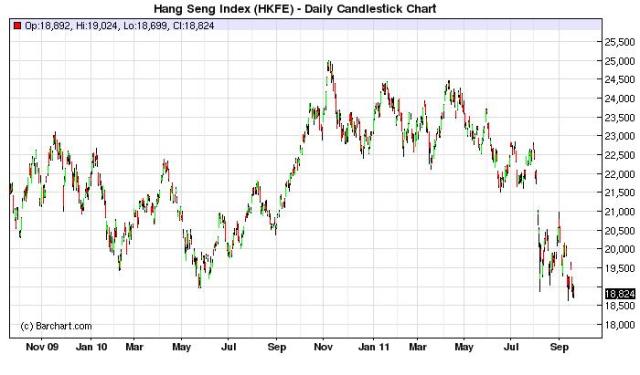

The sharp correction in gold, silver and mining stocks continues. In just 3 weeks, here is where we stand:

GLD: -15%

SLV: -28%

GDX: -18%

GDXJ: -27%

It is not a pretty picture - to say the least! It takes a strong stomach to handle this volatility.

What is Rick Rule, founder of Global Resource Investments, one of the most respected veteran resource investors and self-proclaimed contrarian investors doing with his own money right now? In an interview this week with King World News, Rick Rule answers this question and more. Good insights. Rick Rule: What we are seeing in the markets right now is exactly the type of psychotic break, the type of non-fundamentally related volatility, that has over the last twenty or thirty years given us the entry points that have, in fact, built our track record.

The idea that 30 year US Treasuries are safe seems to me to be a widely held perception that’s wrong. . . . What I am doing by buying bullion is taking the back side on a trade of a widely held perception that I believe to be wrong. I am further, if you will, taking that trade on steroids by buying the smaller market cap advanced stage developers or small producers.

I think what’s causing the volatility in these markets in the very near-term is a constraint in credit. The European banks, in particular, have been big providers of credit in the commodities business. The European banks have less availability of near-term credit themselves and so they are cutting back credit lines to their commodity related customers.

The set of circumstances you are seeing now in commodity markets, this extraordinary volatility, is a function, in the very, very near-term, of increasingly constrained credit markets and that is going to continue for a while.

I see a bit of a rebound this week as gold is oversold, and then the decline may resume, but I’m not sure I see gold settling on a daily basis below $1,500. What’s important here, Eric, is that the action that we are seeing now isn’t fundamental action, it’s volatility.

The junior producers, the sub $1 billion or sub $250 million stocks, are absolutely being decimated. In particular, the stocks that are being decimated are in frontier markets in places like West Africa or South America or Asia. So I’m going to be concentrating my efforts on the most decimated sectors in the precious metals markets. Bullion markets are being decimated with people moving into long US dollar instruments. I’d like to be on the other side of that trade, and I’m going to.

Disclosure: I am a client of Global Resource Investments